If you want an illustration of the utter intellectual bankruptcy of our Keynesian policy overlords just review the attached Wall Street Journal piece on yet another downgrade by the EC of its official economic growth forecast. What’s illuminating is not that the savants of Brussels were wrong by a country-mile yet again, but that they persist in a mechanistic numbers game that resembles nothing so much as ritual incantation.

Yep, the Keynesian priesthood is operating from sacred texts and magic numbers. One of these revelations says that 2% inflation was decreed by the great god of GDP and that any shortfall will precipitate his wrathful extractions from growth and jobs. But there is not a shed of empirical evidence for 2% versus 1% or 3% annual change in consumer inflation—–even if it were honestly measured. Its just revealed word as transmitted by the Keynesian priesthood.

Another sacred tenent avers that in handing down the laws of proper economic life, the Keynesian creator ordained that governments everywhere and always must strive to bring GDP growth to its full employment “potential” rate. No exceptions. World without end.

While the texts are not clear on the precise numeric value of this divinely ordained rate of potential GDP growth, today’s congregants claim that it’s about 3%, reflecting the historic trend growth of the labor supply plus productivity gains. In fact, however, we have achieved only about half of that—about 1.8% per annum—-in the US during the last 14 years, and even a lesser fraction in Europe.

Accordingly, this imaginary trend line of “potential GDP” is now far above actual output levels. This yawning gap between the real economy and its revealed potential, in turn, enables the Keynesian priesthood to demand an endless crusade by the fiscal and central banking agencies of the state to close it.

This essentially means that the state’s economic apparatus is now all about stimulus, all of the time. In fact, the state’s central banking branch has gotten so deep into ritualized Keynesian governance that it’s essentially attempting to micro-manage vast accumulations of GDP—-about $17 trillion each in the US and Europe—-on a monthly basis.That’s entirely what the meeting statements and post-meeting press conferences are all about.

Yet this is absurd. The information flow in a $17 trillion economy is far too vast to be digested and assessed by the 12 mortal members of the FOMC, and their policy control instrument—-the bludgeon of interest rate manipulations—- could not possibly shape its short-run course in any event. That’s especially true since the macro-economy is not a closed system, but one open to every manner of complicating and countervailing influence from trade, capital flows and financial impulses in a $80 trillion global economy.

Still, the Keynesian policy apparatchiks have not even an inkling that they are attempting the impossible or that their patter about objectives, forecasts and policy actions have gotten downright moronic. And here’s where the EC’s latest retreat on its official forecast is so ludicrously illustrative.

Given the massive complexity of the global economy—plus the tidal forces being unleashed by Japan’s yen destruction campaign, the cooling of China’s monumental construction binge, the dead-in-the-water bankruptcy of most of Europe and the massive shift of income and wealth to the top 1% in America— no one in their right mind should attempt to predict GDP growth to the exact decimal point three years into the future or even one year for that matter. There are imponderables, uncertainties and aberrations everywhere, and none of them are in the Keynesians’ primitive DSGE models.

Yet like the Keynesian apparatus everywhere in the modern world, the EC bureaucrats are pleased to try, and feel compelled to make hairline adjustments twice a year—-mainly to cover their chronic back-pedaling on the near-term picture which, in any event, reveals itself soon enough.

Thus, not too long ago the EC projected that real output gains averaged across 18 hugely divergent eurozone economies would average 2.5% during 2015. By the time of this year’s spring forecast revision, the projection was down to 1.7%; and now its fall update downgrades it further to 1.1%. Yes, and while they were splitting economic hairs, the EC prognosticators decided to embrace nine months of “disappointing” reality that has already occurred and lower the 2014 forecast to 0.8% from the spring level of 1.2%.

While it was at it, the EC also resurrected its 1.7% GDP forecast—-which was projected for 2014 awhile back before it was lowered in semi-annual nicks to its current 0.8% level. It seems that this magical 1.7% growth number for the third year forward is never really abandoned; its just rolled forward year after year. Indeed, it had earlier been shuffled forward to 2015, but since that now seems out of reach, the Brussels prognosticators had no trouble seeing it coming clearly into view for 2016.

This paint-by-the-numbers ritual is ridiculous because it makes not a wit of difference whether the outlook for GDP three years into the future is 0.8%, 1.2%, 1.7% or any other number in that range. Its just noise and foolishness.

Why then do they persist in this pointless forecast ritual? Well, because it is written in the sacred texts that policy action to close the GDP gap is imperative, and that the size of the gap and the requisite policy interventions depend upon a macro forecast. The latter is, in effect, their policy intervention map.

However, now that the output gap has become massive and the central bankers believe that there is vast “slack” in the labor force—- which is partly reflected in Europe’s official unemployment rates and largely obfuscated by the BLS’ dummied up U-3 numbers here—the Keynesian project faces a rude reality. Namely, that it is virtually impossible to believe that the “gap” and the “slack” are due to cyclical factors.

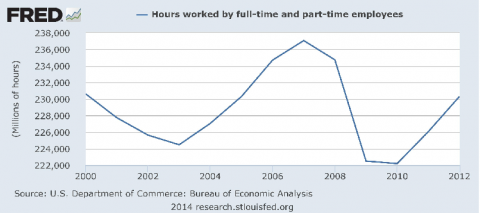

Two simple time series prove the case. First, there has been virtually no increase in non-farm labor hours actually consumed by the US economy over the past 15 years. That’s not cyclical—–its a disastrous fundamental condition or trend.

Secondly, real median household incomes have been trending down for the past 15 years, as well. That too is not about temporary “cyclical” slack; it is a measure of a failing, decaying national economy.

So today’s perpetual stimulus policy is utterly unsuited to the real problems at hand because these deep challenges dwell on the supply side of the economy. The latter has become freighted down with debt, taxes, regulatory barriers, crony capitalist inefficiencies and welfare state inducements to dependency. They have nothing to do with “aggregate demand”, and couldn’t be solved with even more household and business borrowing on top of the mountains of debt already on their balance sheets. The Fed’s lunatic ZIRP policy has already proven that it can’t actually stimulate credit fueled spending for consumer and capital goods owing to the roadblock of “peak debt”.

Yet the Keynesian apparatchiks continue to demand counter-cyclical “stimulus” because they are intoxicated in ritual incantation based on an earlier, more primitive Keynesian catechism. Those original texts called for episodic action at the bottom of the business cycle to prime the pump and overcome recessions. Stimulus was the exceptional condition, not the norm; it embodied the notion that after the state’s kick start——market capitalism could largely take care of itself. The corollary was that fiscal and monetary policy would rapidly normalize once the recovery commenced.

Indeed, the “business Keynesians” of the early 1960’s promised that there would be an off-setting fiscal surplus during the top half of the cycle. Therefore “counter-cyclical deficits” were not a form of monetization of the state’s debts because the borrowing involved was held to be only temporary (i.e. would be repaid from recovery period surpluses). And central bankers like the great William McChesney Martin, who was no Keynesian at all, actually did endeavor to “lean against the wind” during the up-cycle and even take away the punch bowel just when the party got started.

But somewhere during the last two decades the Keynesian stimulus project migrated from the fiscal authorities to the central banks. This had far-reaching consequences because it shifted the locus of policy making from the unruly, paralysis prone machinery of legislative budgets and taxes to unelected bureaucrats and academics endowed with virtually plenary powers and 13 year terms.

What is worse, it put them in the full-time business of fiddling with the money and capital markets in the false belief that they could control the evolution of the macro-economy through its financial nerve center and deftly guide GDP back to the ordained path of full employment.

Consequently, all hell has broken loss. These interventions have not levitated the real economy, nor have they closed the imaginary output gap. Instead, massive central bank stimulus has destroyed honest capital markets and enabled a giant casino of speculators to feast on the free money and market props, puts and bailouts offered by the central banks.

Yet the true danger is not simply that the Keynesians are caught in a time warp. That is, that the fiscal Keynesianism taught by James Tobin in the 1960’s was OK because it was counter-cyclical help from the state to the private economy, but the 24/7 central banker Keynesianism practiced by his PhD student, Janet Yellen, has gone too far and is now obsolete.

No, Keynesianism was always wrong. It is predicated on the alleged inherent cyclical instability of market capitalism, and a purported tendency to chronically tumble into recession, depression and an economic black hole absent the ministrations of the state.

But the evidence for that is the founding event of the Keynesian gospel—–the Great Depression of the 1930s. Yet tragic as it was for mankind everywhere, the disaster of the 1930’s was not due to the inherent instabilities of capitalism or an unregulated free market.

Instead, the Great Depression was born in the financial mayhem of World War I, which destroyed the monetary system and engulfed the world in debt and inflation; and in the 1920s manipulations of the Fed, Bank of England and other central banks as they attempted to restore the pre-1914 status quo ante without the fiscal and financial discipline that was part and parcel of the prosperity and stability that flowed from the liberal international order based on the gold standard and free trade in goods, capital and labor.

All the milder business cycles since then have been generated by the state. These include the excesses of war finance and an overheated economy, as in the case the Korean and Vietnam wars; and the peacetime spells of excessive credit creation enabled by central banks, which had to then correct their own excesses through monetary stringency and recession.

In open economies and a global trading system the only thing which counts is prices, not aggregates. America’s problem is that its production costs and labor prices are too high and its subsidies for inefficient production and non-production are too great. That is the reason why there is so much labor “slack” and why the growth of output and wealth has been so tepid since the late 1990s when the “china price” became the driving force in the global economy.

Stated differently, the Keynesian notions of “potential GDP” and “aggregate demand” have no basis in the real world. They are revealed doctrine. They are the religion of the state’s economic policy apparatus.

Its bad enough that this destructive economic religion leads to the farcical forecasting games evident in the EC’s chronic updates and slow-walks of the GDP numbers down. The evil, however, is that the Keynesian apparatchiks will not desist in their destructive money printing and borrowing until they have suffocated free market capitalism entirely, and have monetized so much public debt that the financial system simply implodes.

The European Commission on Tuesday cut its growth forecasts for the eurozone and the European Union, citing the tensions in Ukraine and the Middle East along with a lack of investment.

The EU’s executive arm now also expects inflation in the eurozone to remain below the close-to 2% targeted by the European Central Bank until at least 2016. That is likely to boost expectations of stronger measures by the ECB such as large-scale purchases of government bonds and other assets.

The commission said it now expects gross domestic product in the 18-country eurozone to grow 0.8% this year, down from 1.2% growth it forecast this spring. In 2015, the eurozone economy will likely grow 1.1%, also less than the 1.7% growth seen in the spring. In 2016, growth in the currency union will rise to 1.7%, the commission said.

The forecasts for the eurozone were dragged down by lower than-expected growth in big countries, including Germany, France and Italy, the latter of which expected to fall back into recession this year.

The picture looks only mildly better for the broader EU. The 28 EU countries are now expected to grow on average 1.3% this year, down from 1.6% growth seen in the spring. Next year, EU GDP is expected to rise 1.5%, also below the 2% previously forecast. In 2016, growth is seen reaching 2%.

“The economic and employment situation is not improving fast enough,” said Jyrki Katainen, the European Commission’s vice-president for jobs and growth. “The European Commission is committed to use all available tools and resources to deliver more jobs and growth in Europe.”

Significantly for investors, the commission said eurozone inflation is likely to be 0.5% this year and 0.8% in 2015. Even in 2016, inflation in the currency union is forecast at just 1.5%, still below the close-to-2% targeted by the ECB, the commission said. Those 2014 and 2015 forecasts undershoot the ECB’s own inflation expectations released in September. At the time, the ECB said it expected eurozone inflation to be 0.6% this year and 1.1% in 2015.

Low growth and low inflation will make it much harder for the eurozone to recover from its debt crisis, causing big problems for high-debt countries such as Greece, Italy and Spain, among others.

Although most analysts don’t expect the ECB to announce new measures to stimulate inflation at its meeting on Thursday, Tuesday’s forecasts are likely to raise expectations of future action, including larger-scale asset purchases as were previously done by the U.S. Federal Reserve and the Bank of England.

Tuesday’s forecasts also form the basis for the commission’s assessment of national governments’ 2015 budgets. While the lower-than-expected growth could mean some countries get extra time to bring their deficits below the 3% of GDP allowed under EU law, they are also likely to underpin demands for new cuts in some countries, including France and Italy. According to the forecasts, both Paris and Rome will fail to cut their 2014 deficits by as much as previously promised, even when the effects of the weak economy are stripped out.

Best Online Slots (Free Games) 2021 - DrMCD

ReplyDeleteFree Slots, 구리 출장마사지 blackjack, roulette, 남양주 출장샵 and 대전광역 출장안마 more. Play slots for free, read 창원 출장마사지 the reviews and leave a rating 창원 출장마사지 or comment.