Trend #1: Central Planning intervention in stock and bond markets will continue, despite diminishing returns on Central State/Bank intervention

Trend #2: The omnipotence of the Federal Reserve will suffer a fatal erosion of confidence as recession voids Fed policy and pronouncements of “recovery"

Trend #3: The Mainstream Media (MSM) will continue to lose credibility as it parrots Central Planners’ perception management

Trend #4: The failure of what is effectively the “state religion,” Keynesianism, will leave policy makers in the Central State and Bank bereft of policy alternatives

Trend #5: Economic Stagnation will fuel the rise of Permanent Adolescence

Trend #6: Income, the foundation of real economic growth and wealth-distribution stability, will continue to stagnate

Trend #7: Small business—the engine of growth—will continue to decline for structural reasons

Trend #8: Territorial disputes will continue to be invoked to distract domestic audiences from domestic instability and inequality

Let’s see how the trends developed in 2013:

Trend #1: Intervention yielded outstanding returns on corporate profits and stocks, but diminishing returns on employment, household incomes for the bottom 80%, and growth, all of which are historically subpar:

Trend #2: The Fed’s members are still regarded as heroic demigods who benignly manage the Earth’s economy. When (not if) the stock market rolls over in 2014-15, Fed omnipotence will suffer.

Trend #3: This one is difficult to track, but anecdotal evidence (declining circulation of many mainstream print media, declining viewership in some cable news channels, etc.) may reflect rising disenchantment with the media’s coverage of key issues.

Trend #4: I think it is quite clear that the Fed and its posse of experts have no alternatives to ZIRP (zero interest rate policy) and QE (quantitative easing).

Trend #5: This one is difficult to monitor. If we use the percentage of young people still living at home and the rise of “selfies” (photos taken of oneself), then perhaps a case can be made that this trend is already visible.

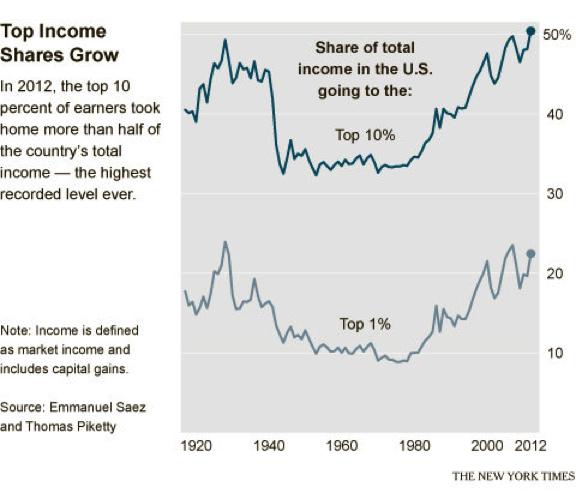

Trend #6: Median household income has edged up, but I suspect this is the result of higher incomes for the top 10% rather than widely distributed gains. Since the top 10% collect 51% of all income, it stands to reason that increases flowing to the top will boost median income even if the bottom 90% sees declines in income:

Trend #7: The unintended consequences of the Affordable Care Act have yet to fully play out.

Trend #8: China’s recent invocation of a “defense zone” that includes the Senkaku Islands suggests this trend is definitely in play.

Outcome #1: The counterfeiting of risk-free assets will continue to be a primary policy of the Status Quo.

Outcome #2: Risk will continue to be transferred en masse to the public.

Outcome #3: Democracy in America is officially dysfunctional.

Outcome #4: Incentives will continue to be structurally perverse, and the rule of law will continue to be bent by individuals, enterprises, and the government.

Outcome #5: Health care (a.k.a. sick care) will continue to be an enormous drag on the economy as diminishing returns, fraud, complexity, and defensive medicine add costs without equivalent improvements in health.

Outcome #6: The costs of complying with Obamacare will act as an inflection point in the decline of small business

Outcome #7: The trend of the Status Quo “solving” perceived problems by adding layers of immense complexity to systems already suffering from marginal returns will continue.

Outcome #8: The informal cash economy will continue expanding, as those who choose to opt out of the Status Quo and those who must opt out as a survival mechanism do so.

0 comments:

Post a Comment