It is truly ironic to see Lawrence Summers and Paul Krugman promote sustaining asset price inflation as the only viable option left to get away from secular stagnation. The curiosity is that Krugman does this invoking Keynes, while Summers has been co-responsible for engineering one of the greatest bubbles of all times, which ended in the Great Crisis. But let me leave aside this issue and the not so unimportant practical issue of how central banks and treasuries manage sustained asset price bubbles and instead turn to consider the logic of their argumentation.

Mario Seccareccia’s note last week did a great job of showing how the Summers/Krugman “liquidity trap” argument is just the old Wicksellian loanable funds market, which has acquired something like the status of a folk theorem in economics. “Within this neoclassical theoretical box”, the note states, “there is only one solution to move the economy out of secular stagnation. One must boost the Wicksellian “natural rate” by strengthening expectations of return.” This could be done, as the note argues and following Wicksellian logic, by a policy of negative real interest rates (amounting to a fiscal subsidy on borrowing) which might do the job of triggering an asset bubble.

What the note does not state so clearly, however, is that Wicksell assumed that the loanable funds market operates in a situation of full employment, i.e. income would be at the full employment level. The (natural) interest rate would then balance savings supply and investment demand, only affecting the composition (but not the level) of full-employment income. Keynes argued, of course, that it was possible for investment and saving to be equal at any level of income, which implies that the equilibrium rate of interest might be consistent with any amount of unemployment. Applying Wicksell’s loanable funds model in a blatantly non-full employment context, as Krugman and Summers are doing, is – therefore – a red herring, distracting attention from the real issue, which is: unemployment due to lack of demand.

Secondly, however perverse a monetary policy of negative real interest rates may be, I do think it is unlikely to have much of an impact in the current balance-sheet recession. The heavily-indebted private sector (mainly households) will take the credit (plus subsidy) to pay down its debts – yes, perhaps part of it will spill-over in higher asset prices (somewhere), but most will be used to reduce the debt overhang, without much impact on the real economy.

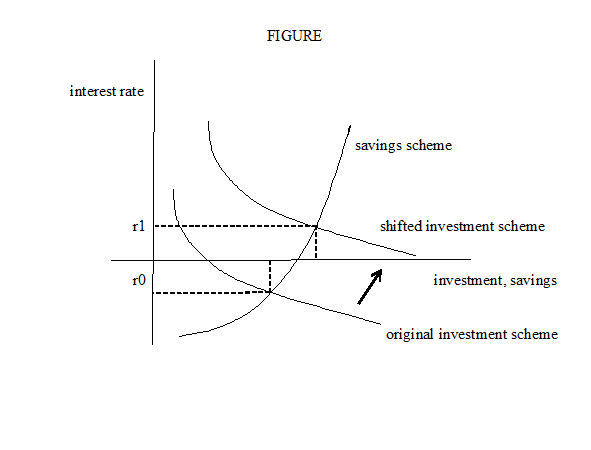

Now back to Summer’s and Krugman’s (faulty) Wicksellian logic. I am puzzled why they ignore the fiscal policy option. The position of the investment schedule (loanable funds demand) clearly depends upon the interest rate as well as the state of confidence of business investors. But it also depends on public investment. If public investment is stepped up, this raises the demand for loanable funds. With an unchanged loanable funds supply, the interest rate must go up, in the process crowding out interest-rate sensitive private-sector investment. New Consensus Economists never grew tired, back in the pre-crisis days, of pointing to the crowding-out impact of expanded public investment. But if it worked back then, it should also work now: any increase in public investment will push up the investment schedule (see FIGURE below) and this will help in raising the interest rate, increasing savings as well as aggregate investment – especially because (a) the savings scheme will be rather steeply increasing (people save out of the precautionary motive, and less in response to the interest rate); and (b) private investment will be overwhelmingly dependent upon a lack of confidence of the business investors (and less affected by the – low – interest rate).

What I am arguing, therefore, is that Summers ignores the potential role which “expansionary Keynesian fiscal policy of massive public investment” might play in his own hybrid model, while Krugman’s enthusiasm for quantitative easing is really quite inconsistent with his often stated support (since the start of the crisis) for greater deficit spending. Their current silence on the recovery-role to be performed by public investment helps make the public believe that “asset price inflation” is the only way open to avoid a secular stagnation. Whatever they think privately, it all adds up to a public case for the idea that the only route to recovery goes through Wall Street itself.

Source

Popular Posts

-

International Business Lawyers salaries - Salaries of an International Business Lawyers by CSIS: Center for Strategic & International S...

-

If you are somebody that is determined by the month to month wages to handle your bills, an unexpected mishap is the last item you want. Th...

-

It is fitting that Goldman Sachs is the recipient of this year’s “Public Eye” designation, but it is even more fitting that it is being anno...

-

Could rapidly falling oil prices trigger a nightmare scenario for the commodity derivatives market? The big Wall Street banks did not expec...

-

The Translation of Paperwork Is a International Business Necessity by kk+ The Translation of Paperwork Is a International Business Necessi...

-

International Business and Types of International Business by Think London - connecting business to London International Business and Typ...

-

When we have to do various activities every day, it must be true that some of them will make us get involved with emotion and energy exposin...

-

VH International Business Solutions by shawncalhoun VH International Business Solutions What do we do here at VH International Busines...

-

In April 2014, fresh from riots against the kleptocrats in Maidan Square and the February 22 coup, and less than a month before the May 2 ma...

-

Stock markets set to take off as Europe, Asia abandon austerity ... The Great Divergence is a term coined by economic historians to explain ...

Blog Archive

-

▼

2013

(260)

-

▼

December

(21)

- Price of Gold Part of a Larger 'Party' Pattern?

- “Honey, I Shrunk Killed the Middle Class”

- The Stock Market Has Officially Entered Crazytown ...

- Now China ... Reasons for Printing Money Abound

- Wolf Richter: Financial Engineering Wildest Since ...

- On The 100th Anniversary Of The Federal Reserve He...

- Banks Start Volcker Rule Blame Game

- Did Someone Say “Crash”?

- US Treasury's Financial Crimes Enforcement Network...

- Obama Allows Great Lakes Water To Be Sold To China...

- JPMorgan's "Bitcoin-Alternative" Patent Rejected (...

- Will Opposition in the US and Overseas Derail the ...

- Real Reason for the US's Global Tax Levy

- Why Our Consumer-Debt Dependent Economy Is Doomed

- Of Keynesian Cul-De-Sacs And The Fed Creating More...

- 37 Reasons Why “The Economic Recovery Of 2013″ Is ...

- The Chinese Want To Spend Billions Constructing A ...

- Mercantilist Monsanto: Driver of Organic Farming

- Too Big To Fail Banks Are Taking Over As Number Of...

- Gold Drops Below Cash Cost, Approaches Marginal Pr...

- Servaas Storm: Some Remarks on “Larry Summers, Sec...

-

▼

December

(21)

Copyright © 2011 International Business | Powered by Blogger

0 comments:

Post a Comment